Exchange Highlights: A Sub-Dollar Surge and Rising Retail Activity

A Sub-Dollar Surge and Rising Retail Activity

Highlights & Recent Developments

- MEMX exchange market share was 5.3% in April

- Sub-dollar trading hit a record of 16.1% of volume in April, driving TRF market share to 44.9%

- MEMX retail trading was 9.1% of add volume with high fill rates

- Odd-lot research shows benefits of round-lot reform in higher-priced stocks

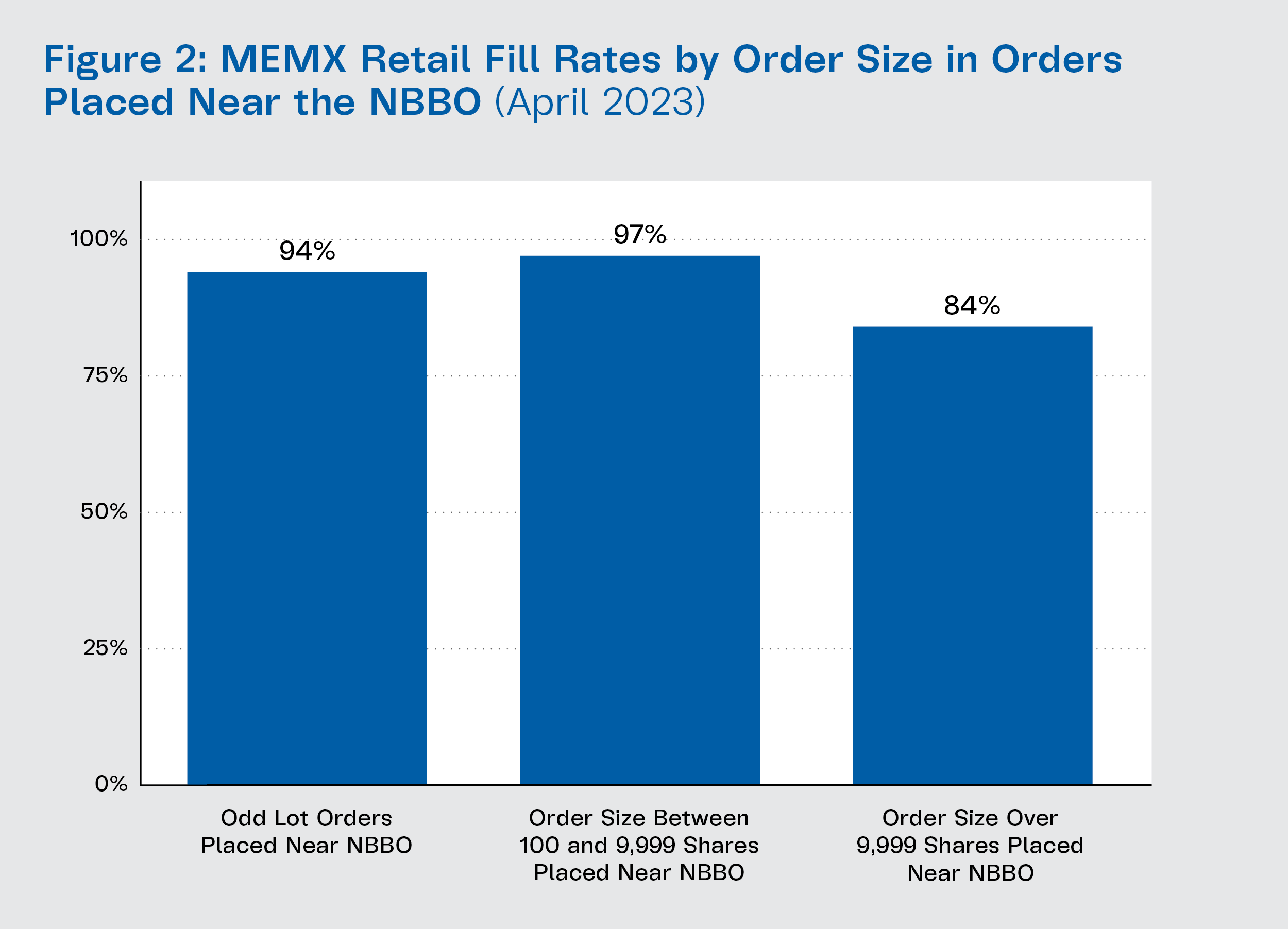

- Update on MEMX Options exchange ID codes

Equities Highlights

In April, MEMX exchange market share (excluding TRF volume) was 5.3%, and the exchange quoted over 75% of the time at the NBBO in 2,005 symbols. MEMX NBBO setting activity was nearly 13% of quoting across exchanges.

Sub-dollar trading hit an industry record of 16.1% of consolidated volume in April, the largest percentage in over three years. Significant sub-dollar trading contributed to high TRF market share, which was nearly 45% overall and 50% in Tape C securities.

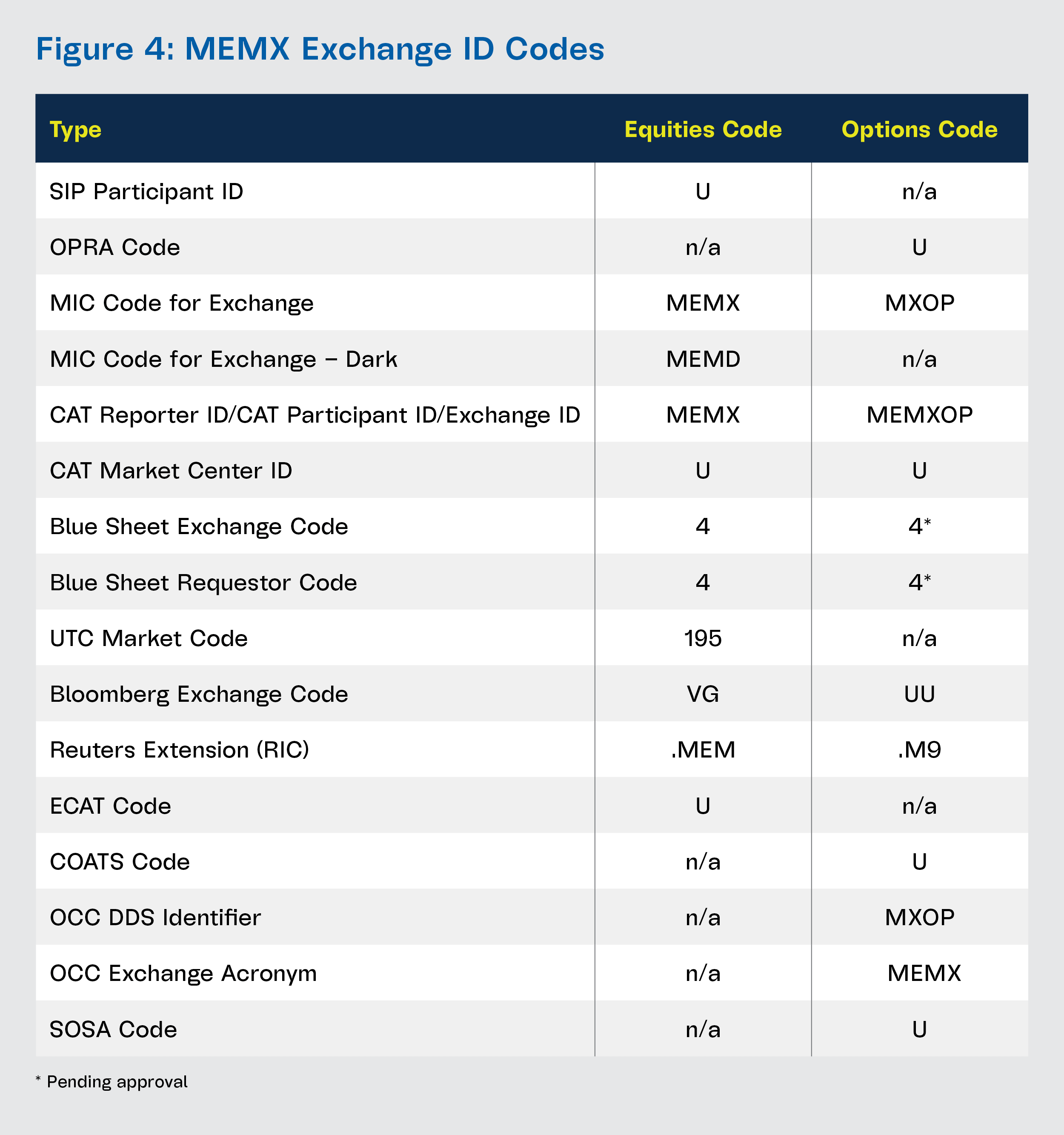

Retail trading accounted for 9.1% of MEMX liquidity provision, with average retail fill rates on orders priced near the NBBO at 94% for odd lots and 97% for order sizes between 100 and 9,999 shares (Figure 2). Sub-dollar stocks MULN and BBBY were the most active retail stocks on MEMX based on shares traded. The most active retail stocks on MEMX based on notional traded were TSLA, NVDA, TQQQ, and SPY.

Odd Lot Data Highlights Benefits of Round-Lot Reform

Recent comment letters expressed significant industry support for expediting round-lot reform on the exclusive SIPs, which will lower the round lot size in stocks priced over $250. Figure 3 provides odd-lot trading data by stock price bucket on a recent day and highlights the following:

- 85% of trades were odd lots in stocks priced over $250, which was the highest percentage among the stock price buckets

- The average quoted spread in basis points (based on the SIP NBBO) was highest in stocks priced over $250

- 29% of odd lot volume was executed inside the artificially-wide SIP NBBO, which was the highest percentage among stock price buckets

The data highlights the likely benefits to come from round-lot reform, including narrowing the SIP NBBO spread, protecting aggressively-priced odd lot quotes, and reducing related transaction costs for investors.

Options Exchange Identifiers

MEMX plans to begin trading options on August 7, 2023. Technical specifications are available at memxtrading.com. Below is a list of MEMX equities and options identifiers, which will continue to be updated here.