Exchange Highlights: MEMX Delivers Continued Positive Metrics and Announces a New Technology Partnership

Record Price Setting, Growing Midpoint Activity and High Retail Fill Rates

Highlights & Recent Developments

- MEMX exchange market share excluding TRF trading was 5.1% in September

- MEMX NBBO setting hit a new record, growing to 12.8% of setting instances across all exchanges

- Midpoint activity grew 28% in September with significant time-at-mid opportunities

- Retail fill rates were 94% in odd lot order sizes and 97% in order sizes between 100 to 9,999 shares

- MEMX is providing trading technology to new digital asset exchange EDX Markets

Market Share

In September, MEMX total market share was 3.0% and exchange market share excluding TRF trading was 5.1%. Looking at other measures of liquidity, MEMX ranked third in the number of symbols quoted over 75% of the time at NBBO. MEMX set the new NBBO price 12.8% of the time in September—a new record for the exchange.

Volume & Diversity of Liquidity

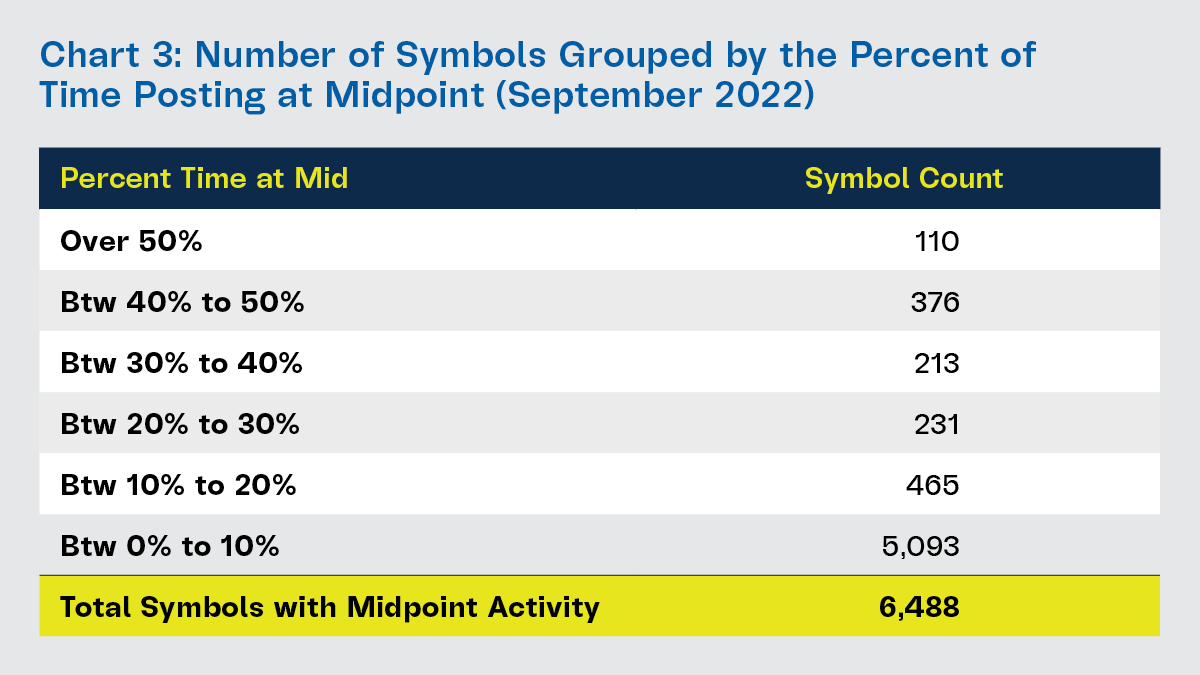

Midpoint activity, including midpoint adding and midpoint IOC orders, grew 28% in September (Chart 2). MEMX traded at midpoint in 6,488 securities. Of those, 110 averaged over 50% of the time posted at midpoint throughout the trading day and 376 averaged between 40% and 50% of the time posting at midpoint (Chart 3).

Retail Trading

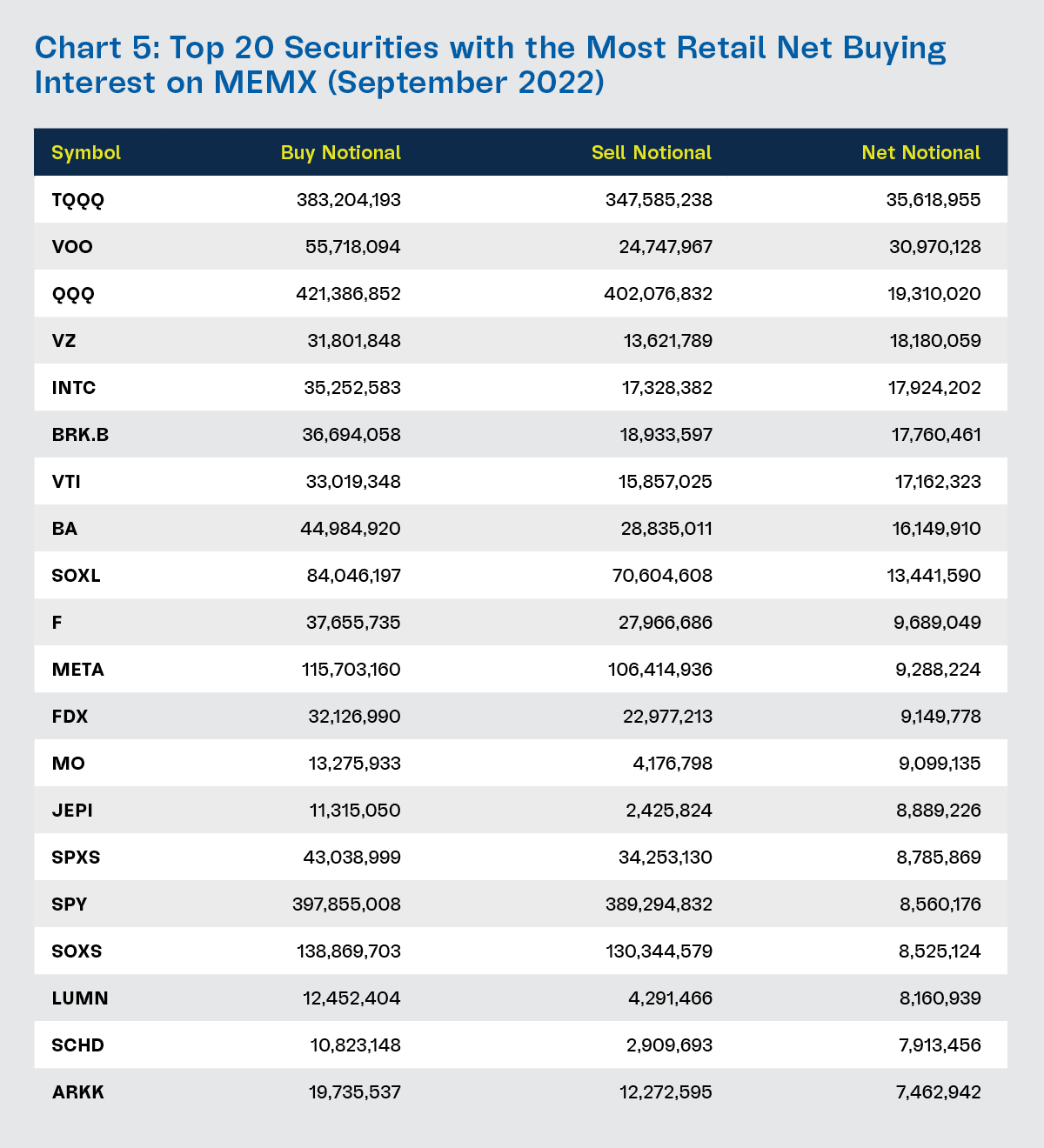

MEMX retail fill rates were 94% in odd lot order sizes and 97% in order sizes between 100 to 9,999 shares (Chart 4). Below we show the top 20 securities trading on MEMX with the most retail net buying interest (Chart 5) and retail net selling interest (Chart 6) in September.

Market Technology

EDX Markets recently announced the launch of a digital asset exchange backed by Charles Schwab, Citadel Securities, Fidelity Digital Assets, Paradigm, Sequoia Capital and Virtu Financial. The new exchange is leveraging trading technology provided by MEMX.