Exchange Highlights: Options Update and Sub-Dollar Trading Trends

Options Launch Date and Sub-Dollar Trading Trends

Highlights & Recent Developments

- MEMX exchange market share was 5.5% in January

- MEMX Options is planned to launch in August 2023, with testing in July

- Overall sub-dollar trading surged to 13.7% of industry volume bringing higher TRF market share of 46.5%

- MEMX retail fill rates in active sub-dollar stocks were 98% for odd lot limit orders placed near the NBBO

- SNDL reverse stock split shows how tick size impacts NBBO spreads and size

Market Share

In January, MEMX exchange market share (excludes TRF volume) was 5.5% and ranked 3rd in number of symbols quoted over 75% of the time at the NBBO in thousands of securities.

Options Update

MEMX plans to begin trading options on August 7, 2023 in a phased rollout. The new exchange will leverage the strengths of MEMX’s data-centric architecture and state-of-the-art infrastructure.

Details:

- Market model: Price/time

- Fee model: Maker/taker (fees to be announced at a later date)

- Functionality: Regular orders only (no complex or crossing orders)

- Key Dates:

-

- User Acceptance Test #1: Saturday, July 22, 2023

- User Acceptance Test #2: Saturday, July 29, 2023

- Launch: Monday, August 7, 2023

- Additional Phases: Monday, August 14, 2023 and Monday, August 21, 2023

- Specifications, industry exchange codes, and member test environment availability are pending

- Existing members can use their existing cross connects for equities to also trade options

- MEMX Options Rulebook (SEC-approved)

- Membership Documents

Sub-Dollar Spotlight

Trading in sub-dollar stocks continued to rise in January, accounting for 13.7% of industry share volume (but only 0.1% of notional volume), well above historical levels (Figure 1). Sub-dollar activity has been higher in recent months and contributed to higher TRF market share given significant off-exchange trading in sub-dollar stocks. Overall TRF market share in January was 46.5% (including 50.8% in Tape C and 60.8% in sub-dollar securities), the highest level in nearly two years.

There were more than 2,300 sub-dollar stocks traded in the month, but volume was heavily concentrated in ten stocks (e.g. MULN, XELA), which accounted for 56% of sub-dollar volume. Retail investors are significant liquidity providers in sub-dollar stocks, and MEMX average retail fill rates in active sub-dollar stocks priced near the NBBO were 98% for odd lots and 93% for order sizes between 100 shares to 9,999 shares (Figure 2). MEMX offers competitive rebates up to 0.15% of dollar value traded for adding liquidity in sub-dollar stocks.

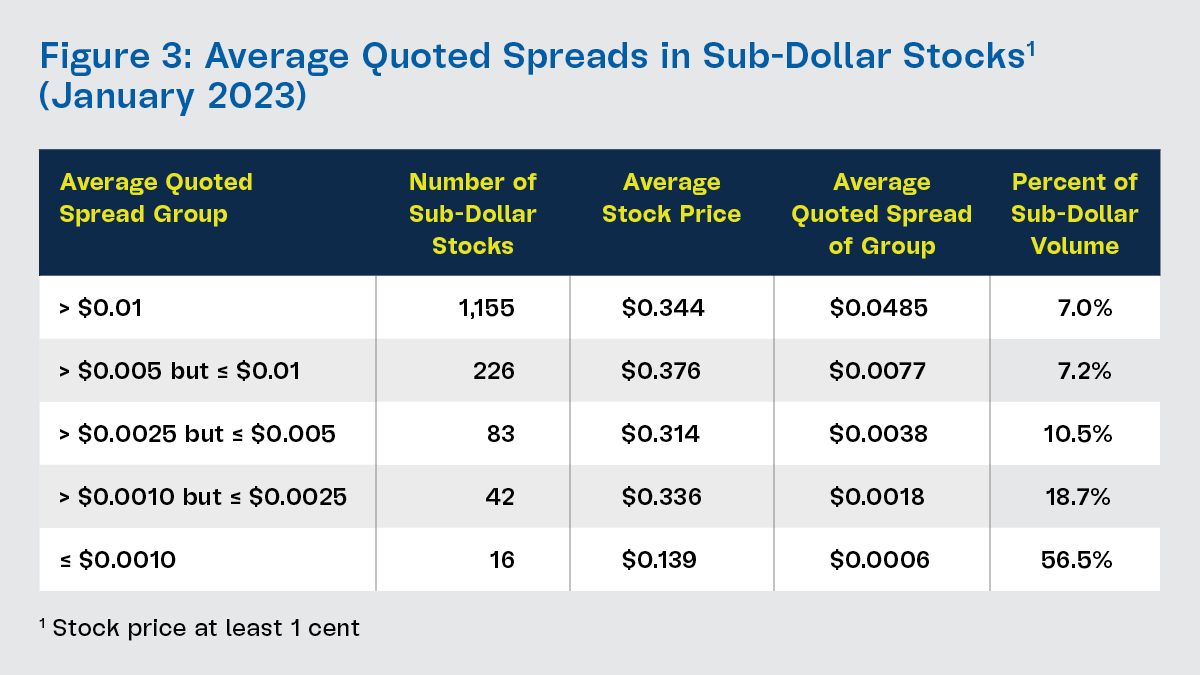

Sub-dollar stocks can trade and quote in a minimum price increment well below $0.01. Figure 3 shows the average quoted spreads in the sub-dollar stocks in January. As shown, 367 stocks had an average quoted spread below $0.01 and accounted for 93% of sub-dollar share volume. Low stock prices of ~$0.30, on average, contributed to lower quoted spreads.

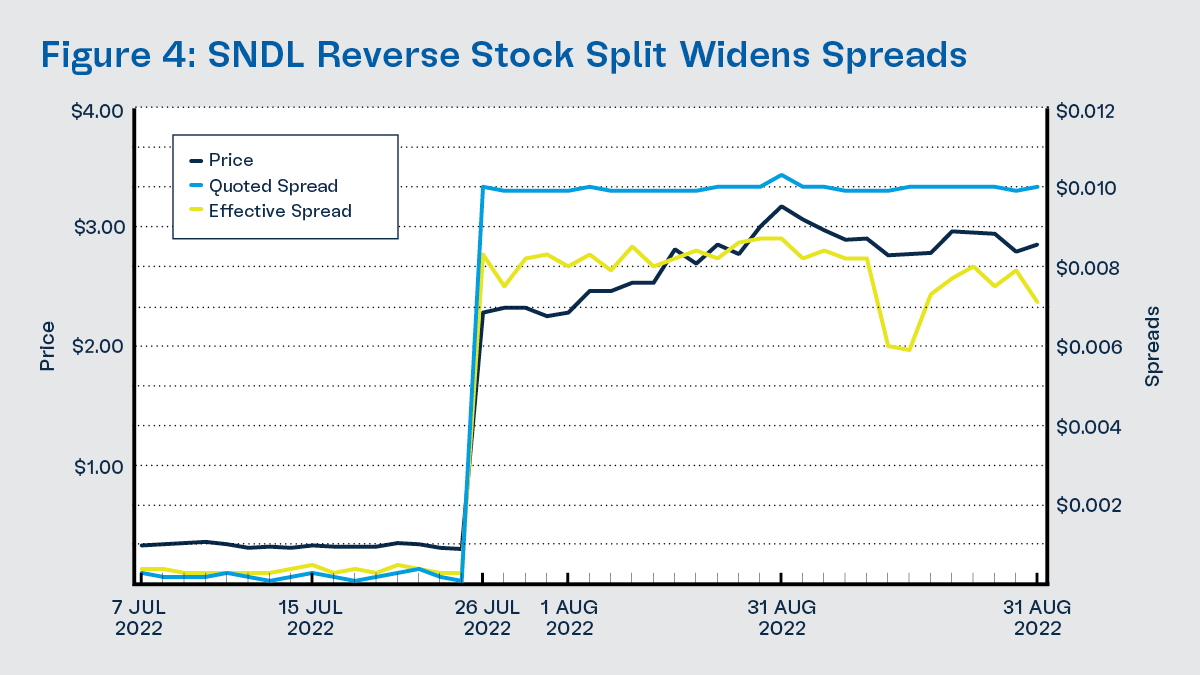

Looking at a stock like SNDL, which previously traded around $0.30 before a 1-for-10 reverse split on July 26, 2022, highlights how the tick size can have a significant impact on quoted spreads, effective spreads, and NBBO size. Following the reverse split that increased the stock price to over $2, SNDL became tick constrained, resulting in significantly wider spreads and higher NBBO notional size as orders aggregated at a single price point. Here is a summary of the findings based on averages over the pre-split and post-split periods:

- Quoted spreads widened by 46 times in cents and 6 times in basis points (Figures 4 and 5)

- Effective quoted spreads widened by 22 times in cents and 3 times in basis points (Figures 4 and 5)

- NBBO notional size increased by 17 times from ~$2,700 to $48,600 (Figure 6)

After the split, the effective spread was lower than the quoted spread, indicating higher inside-the-NBBO trading.

The SNDL example shows the tradeoff between NBBO spreads and size and importance of providing a more flexible tick size regime that allows securities to adjust to the optimal spread and displayed liquidity levels to improve trading for retail and institutional investors.