Exchange Highlights: Robust Quote Performance and Diverse Participation Across Order Types

Robust Quote Performance and Diverse Participation Across Order Types

Highlights & Recent Developments

- MEMX exchange market share excluding TRF volume was 6.4% in April 2022, up from 3.8% in April 2021

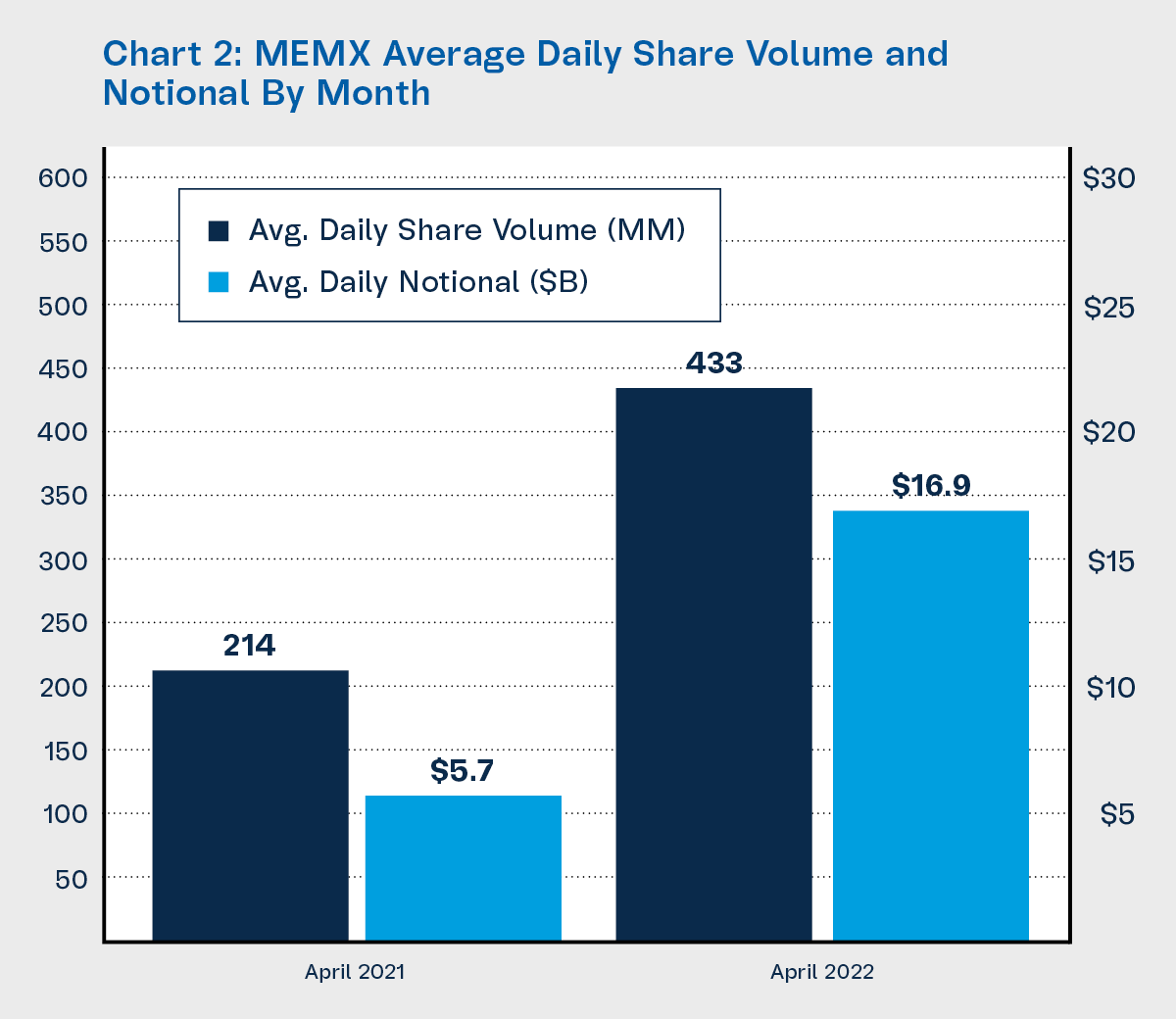

- MEMX average daily volume was $16.9 billion notional in April 2022, up from $5.7 billion in April 2021

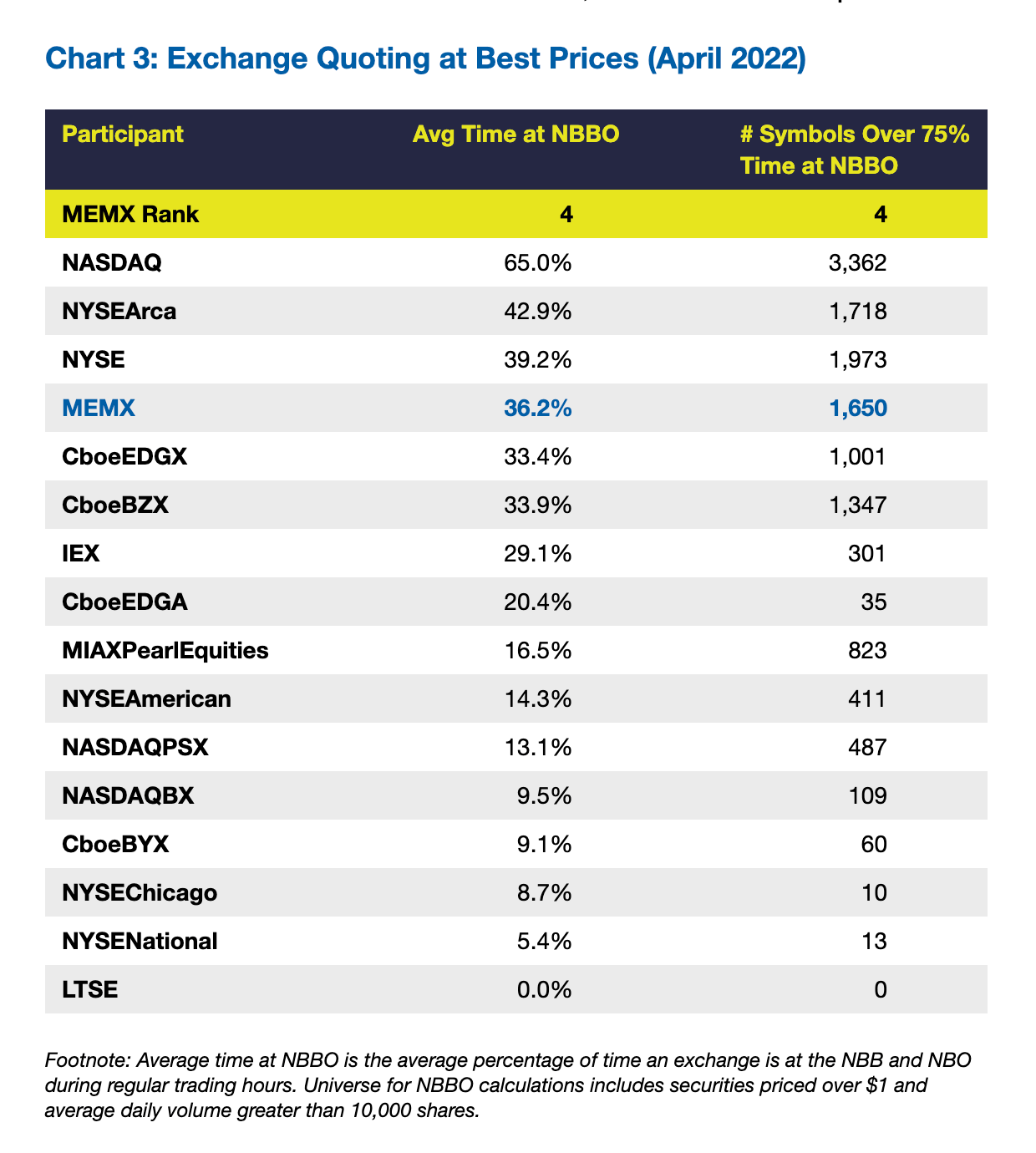

- MEMX ranked fourth in time-at-NBBO quoting in April

- Retail participation accounted for 8.3% of add volume in April

- A closer look at MEMX order type usage shows diverse member participation

Market Share

MEMX exchange market share excluding TRF volume was 6.4% in April 2022, up from 3.8% in April 2021. The high for the month was a 6.74% exchange market share on April 11th.

Volume & Diversity of Liquidity

MEMX average daily volume was $16.9 billion notional in April 2022, up from $5.7 billion in April 2021. The high for the month was $20.7 billion traded on April 25th.

MEMX ranked fourth in quoting based on average time at the NBBO across approximately 7,700 securities in April. MEMX quoted over 75% of the time at the NBB or NBO in 1,650 securities in April.

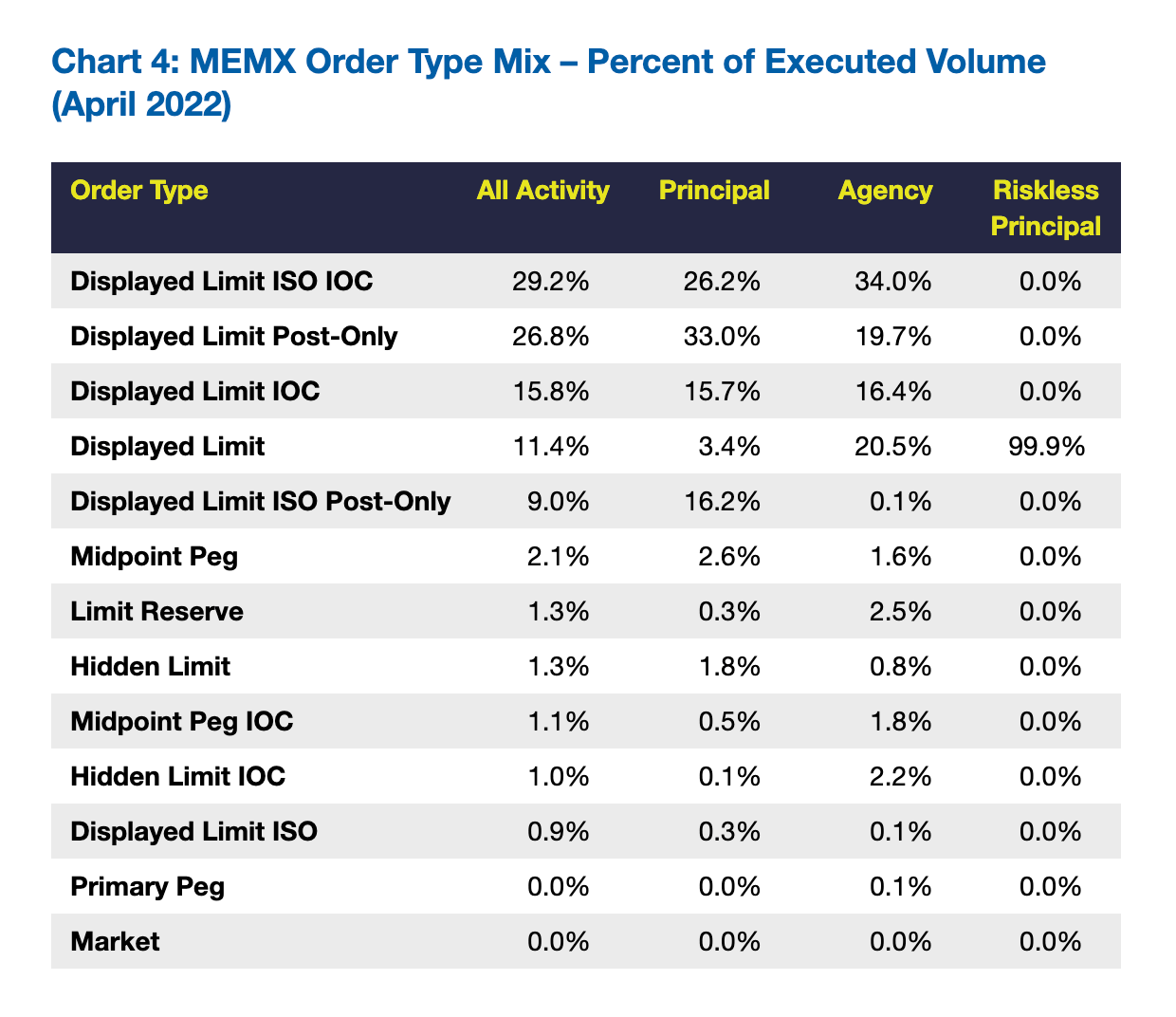

During April, MEMX had 49 active member firms with 55% of volume executed as principal and 45% executed on an agency or riskless principal basis. Retail participation accounted for 8.3% of add volume. The table below shows that the top five most active order types were Displayed Limit ISO IOC, Displayed Limit Post-Only, Displayed Limit IOC, Displayed Limit, and Displayed Limit ISO Post-Only. Principal traders are more active users of the Post-Only modifier, while agency participants are more active users of IOC modifiers that remove liquidity. Midpoint Peg was used by both principal and agency participants. The Reserve feature was used most by agency traders, but on a limited basis. Riskless principal orders were mostly Displayed Limit orders. Additionally, there was limited use of the Primary Peg functionality and Market orders.